Social Security Indexing Factors

Published: 12/28/2020

Yesterday, Josh Scandlen posted a YouTube video discussing the SSA.tools Calculator. One of the concerns raised in the video was that for folks currently under age 62, SSA.tools uses incorrect Indexing Factors. In the example, the user was born in 1970 and is thus 50 years old in 2020. The indexing factors for a 1970 year old will be determined in 2032, at the age that the recipient turns 62. SSA.tools makes all of its calculations using index factors for someone turning 62 in 2021 however, which seems initially incorrect.

Short version. tl;dr:

SSA.tools uses the latest current indexing factors rather than future estimated values so that all of the numbers presented in the report are in "today's dollars". Another way to think of this is that the values are adjusted for future inflation. If you use estimated indexing factors for 2032 while the current year is 2020, the report will present benefits in inflated 2032 dollars amounts, which can give an extra rosy interpretation of one's benefits when comparing against one's current not-inflation-adjusted expenses.

The reports that the Social Security Administration presents operate the same way, using the latest index factors rather than the future estimated values.

Longer version

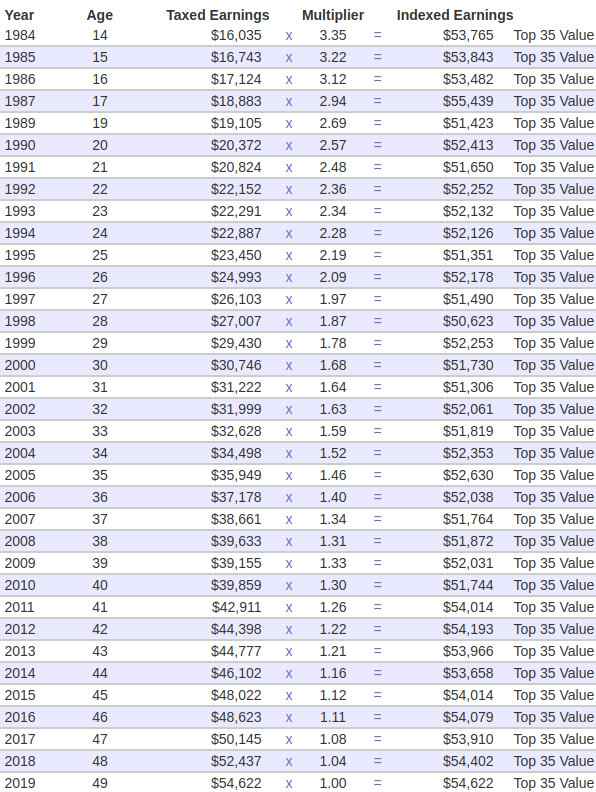

For the sake of illustration, let's consider a social security recipient named Alex born in 1970 and the year is currently 2020. After Alex enters her social security earnings record into ssa.tools, it displays a table that looks like this:

We see that in 1984, Alex earned $16,035 which is multiplied by an earnings factor of 3.35 for an indexed earnings value of $16,035 x 3.35 = $53.765.

Alex then looks at the official ssa.gov Index Factors for Earnings which explains that Alex's year of eligibility will be 2032 when Alex turns 62. Alex enters 2032 and ssa.gov displays a table that looks like this:

The ssa.tools calculator shows an index factor for 1984 of 3.35 while ssa.gov shows 5.0878930, clearly disagreeing. In fact every index factor seems off. Every year is off by approximately the same amount too: the ssa.gov numbers are all 52% higher than the ssa.tools numbers. Why?

On ssa.gov's Indexing Factors page, there is a clue to what's going on:

If Alex instead enters 2021 as the year of eligibility, Alex will get the exact same numbers as ssa.tools uses: 3.35 in 1984 and so on. So, which number is correct?

We first need to understand how the indexing factors are determined. These numbers are not just selected by a governing body; there is instead a simple formula that determines them. The calculation will actually be made in the year that Alex turns 62, which is 2032. In 2032, index factors are calculated for Alex for every year up to and including the year she turned 60. Every year after that, the multiplier will always be 1.0. For the years up until 60, the multiplier for a given year will be the Average Wage Index (AWI) in the year she turned 60 divided by the AWI of the multiplier year:

| Multiplier (year X) = | AWI (year 2030) |

| AWI (year X) |

The problem is that until 2032, we don't know these values. AWI stands for the "Average Wage Index". It is the average of all of the wages reported by everyone in the country in that year. We can't know that value until at least the following year. The data is based on tax returns, so with late filing and so forth, the actual number won't really be known until very late in the following year, which makes it available for use in the year after that (2 years later). This is why 2030 numbers are used in 2032.

The AWI numbers that ssa.gov displays for eligibility years after 2021 are all just estimates based on models of what wages might be like in the future. Nobody knows this for certain yet, but we can make reasonable guesses. The guesses become more accurate the closer we get to that year.

This is why all of the numbers differ by 52% between the 2021 and the 2032 earnings factors. 52% is the estimated increase in average wage between 2019 and 2030. From Table VI.G6 we see that the AWI in 2019 is $53,756.28 and the estimated AWI in 2030 is $81,571.95. $81,571.95 / $53,756.28 = 152%.

Why don't we use the estimates, even if they might be a little off? Inflation.

The difference between the AWI in 2019 and 2030 is wage inflation. The indexing factors exist to adjust for wage inflation over time. The Social Security Administration expects average wages to increase by 52% between 2019 and 2030. Alex's costs will increase as well. If Alex were to compare her 2032 monthly benefit of $3,000 against her 2020 monthly expenses of $2,800, Alex may think that her benefit will entirely cover her expenses with 10% left over. Instead, that $2,800 will cost much more due to inflation by 2032. We don't know the exact amount, but one estimate might be 52% - the amount wages will inflate by then. That $2,800 would then cost $2,800 x 1.52 = $4,256.

By showing Alex's benefit in 2020 dollars, using today's latest AWI from 2019, we show Alex a benefit that she can directly compare to her expenses today. The benefit is approximately "inflation adjusted".

This is the same methodology that the Social Security Administration uses when producing an estimate of your future benefit at retirement age, when you get an annual report either in the mail or at ssa.gov. The estimate assumes you will continue to earn the same amount as last year for every year going forward until age 62. It then applies the benefit formula using this year's Indexing Factors, giving you an estimate in today's dollars.

More reading

There are actually multiple ways to measure inflation. Wage inflation is only one of them, and it varies from price inflation. Typically wages grow a little faster than prices. Price inflation also has an effect on the formula for your social security benefit. To understand more, take a look at our guide on How inflation rate affects Social Security benefit calculations.

The Indexing Factors that adjust one's benefit are all determined based on the AWI in the year that one turns 60 years old. In 2020, Covid-19 has had an unusually large impact on the nation's Average Wages in a manner that will likely negatively impact those who turn 60 that year. If you were born in 1960, take a look at our guide answering the question: Will a weak economy in 2020 result in a benefits decrease for those born in 1960?